12 Best Crypto to Buy Right Now — May 2024

Are you looking to invest in cryptocurrencies but unsure which one to buy? With so many options available, it can be overwhelming to decide how to invest your money. That’s why we’ve compiled a list of the best crypto to buy now, based on factors such as project developments, price performance, and market capitalization, as well as the overall potential for growth.

In this article, we’ll take a closer look at the most promising cryptocurrencies, including staples such as Bitcoin and Ethereum, and a combination of several other promising crypto projects. We’ll discuss their features, advantages, and potential drawbacks, as well as provide insights into market trends. Whether you’re a seasoned investor or just starting out, this article will help you make an informed decision about the best crypto to buy now.

So, let’s dive in and explore the best cryptocurrencies to invest in May 2024:

- Hedera Hashgraph – Crypto network based on the Hashgraph algorithm

- Helium – A decentralized IoT blockchain network

- Toncoin – A blockchain designed by Telegram and run by the community

- Bitcoin – The world’s oldest and largest crypto

- NEAR Protocol – A highly scalable DeFi-focused blockchain

- Dogecoin – The original meme coin

- Worldcoin – A proof-of-personhood crypto project

- Ethereum – The leading DeFi and smart contract platform

- Solana – One of the fastest and cheapest L1 blockchains

- Bittensor – Machine learning blockchain platform

- Fetch.ai – A leading AI crypto project

- BNB – A popular crypto asset enjoying support from the world’s biggest crypto exchange

The 12 best cryptos to buy right now: Discover top investments for May 2024

The following three cryptocurrency projects highlight our investment selection thanks to important developments and upcoming events that make them especially interesting to follow in the near future. These projects are updated each week based on the most recent developments and trends taking place in the crypto market.

1. Helium

Helium is a decentralized blockchain network that utilizes a unique consensus algorithm called “Proof-of-Coverage” (PoC). The network is designed to facilitate the creation of a wireless peer-to-peer network for Internet of Things (IoT) devices.

In the Helium network (which operates on the Solana blockchain), users can earn rewards by deploying and maintaining wireless hotspots that provide coverage for IoT devices. These hotspots communicate with each other and IoT devices using the unique LongFi wireless protocol, which allows for long-range and low-power communication.

The Helium network also features a native cryptocurrency called HNT, which is used to incentivize users to participate in the network and to pay for network services. It is earned by providing coverage with the project’s own hotspots and can be used to pay for IoT data transfers, access to network services, and more.

Why Helium?

Helium jumped more than 35% in the past week, claiming the spot of the largest gainer in the crypto top 100 in the time period. While there’s no direct correlation between recent developments and Helium’s impressive price activity, it’s worth noting that Helium has recently celebrated its 1 year anniversary of Solana integration.

Since Helium transitioned from its own blockchain to Solana, the network has grown to more than 180,000 active users, added more than 80,000 subscribers to its mobile plan, and is growing at a 15.4% monthly rate.

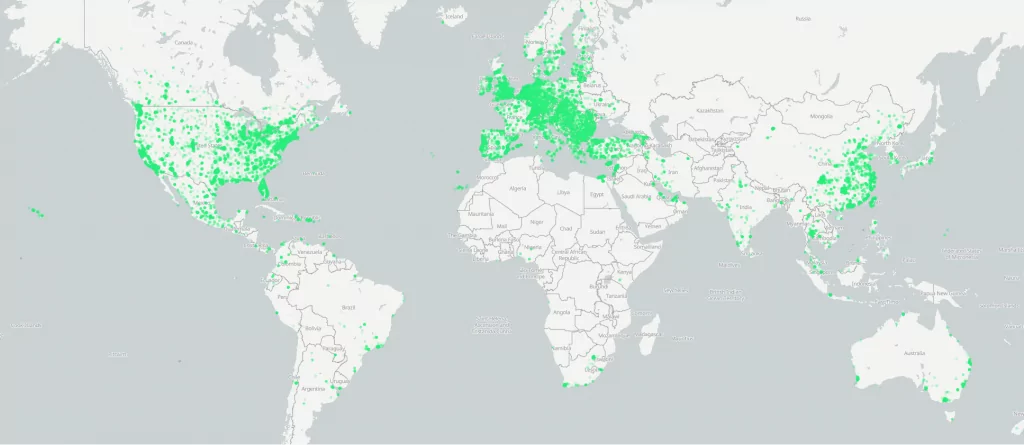

Generally speaking, the Helium network keeps growing at an impressive rate and currently covers pretty much all major population centers across NA and Europe, as well as a decent amount in Asia.

Last year, Helium launched a 5G mobile plan in the US, which allows users to earn MOBILE tokens simply by using the Helium network. The unlimited plan comes in at $20/month, which is very competitive compared to some other services.

2. Hedera Hashgraph

Hedera Hashgraph is a public distributed ledger and cryptocurrency platform that differs from traditional blockchain technology. Instead of a linear chain, it uses a directed acyclic graph (DAG) called “hashgraph” which allows for faster transaction speeds and higher scalability. This architecture enables Hedera Hashgraph to process transactions in parallel, significantly reducing the time and energy required compared to blockchains.

Hedera is governed by a council of diverse organizations, which ensures decentralized governance and security. The platform supports smart contracts, file storage, and offers strong finality, with transactions confirmed within seconds.

The native cryptocurrency of the Hedera network is HBAR. It is used to power decentralized applications, pay for transaction fees, and secure the network through staking. Hedera aims to provide a more efficient, secure, and fair digital economy, positioning itself as a next-generation platform for a wide array of applications.

Why Hedera Hashgraph?

Hedera Hashgraph saw a massive price spike on April 24, with the platform’s native token surging more than 150% from $0.087 to $0.176. The reason for the massive price spike was the announcement of Hedera’s tokenization of BlackRock’s MMF shares owned by the Archax team.

It’s worth noting that the initial reports claimed that BlackRock itself chose Hedera to tokenize its money market fund shares, but that wasn’t really the case. What really happened was that the FCA-regulated crypto company Arcax expanded its offering of BlackRock ICS US Treasury money market fund to Hedera Hashgraph in a tokenized form.

While the clarification that BlackRock wasn’t directly involved in the deal saw HBAR plummet in price, the currency still retained very impressive 15% weekly gains during a time when most cryptocurrencies lost value. Shayne Higdon, CEO of The HBAR Foundation, had the following to say about the partnership with Archax:

“The addition of MMF shares tokenised on Hedera, enabled by Archax, is a huge vote of confidence. Hedera’s unmatched speed, security, and low-cost infrastructure is ideally suited for the institutional-grade tokenisation of real-world assets made possible by Archax.”

3. Toncoin

Toncoin is a platform consisting of multiple components. One of its main components is the TON Blockchain (with TON standing for “The Open Network”), which is a flexible multi-blockchain platform capable of processing millions of transactions per second. It supports Turing-complete smart contracts, upgradable blockchain specifications, and multi-cryptocurrency value transfers. The TON Blockchain incorporates unique features such as a self-healing vertical blockchain mechanism and Instant Hypercube Routing, which ensure fast, reliable, scalable, and self-consistent operations.

In addition, the Open Network comprises of the TON P2P Network for accessing the TON Blockchain, TON Storage for distributed file storage, TON Proxy for privacy protection, TON DHT for distributed hash table functionality, TON Services for platform-based services, TON DNS for human-readable naming, and TON Payments for micropayments. TON aims to make blockchain and distributed services more accessible by integrating with popular messaging and social networking apps like Telegram (which already supports TON and BTC transfers).

The native cryptocurrency of the Open Network is Toncoin, which is used to facilitate deposits to become a validator, and cover transaction fees and gas payments (fees incurred from smart contract message processing).

Initially, the Open Network was launched as the Open Telegram Network by the Telegram team but was later rebranded as the community took over the development of the project. Telegram withdrew from development in 2020 after the litigation with the Securities and Exchange Commission (SEC), which accused the company of selling unregistered securities.

Why Toncoin?

Tether has expanded its offering of USDT and XAUT stablecoins to the TON blockchain. The move aims to leverage Telegram’s 900 million user base to build upon the adoption of Tether’s key stable crypto assets.

As of April 22, just three days after the launch, more than $60 million worth of USDT had already been issued on the TON blockchain. Tether CEO Paolo Ardoino noted in its post on X that USDT on Telegram is off to a “great start.”

The news follows several other significant ecosystem developments that have helped TON emerge as one of the most active crypto assets in the last couple of weeks. For starters, the TON Foundation announced a strategic partnership with HashKey, a Web3 firm offering a wide range of digital asset services, including a crypto exchange and cloud node validation, earlier in the month.

Another potential catalyst for the price of Toncoin is the launch of a native cryptocurrency for the Notcoin game – which has onboarded over 30 million users since launch – in the coming days. The token was slated to launch last week, but the team “needed more time to line things up,” Sasha Plotvinov, co-creator of Notcoin, told Decrpyt. He added that they are aiming to launch the token before the end of April.

Notcoin exploded in popularity when it first launched a couple of months ago, claiming the title of the most active Web3 game for the first couple of weeks. The game allows players to earn coins by tapping on the screen while using a Telegram bot. This in-game currency will be represented by its own cryptocurrency after the launch of the native token sometime in the coming days.

4. Bitcoin

Bitcoin (BTC) is the original decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin was the first digital currency to eliminate the double spending problem without resorting to any central intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This means that the transactions are secure and transparent, as anyone can view them, but they are also anonymous, as the identity of the participants in the transaction is not revealed.

BTC can be bought and sold on cryptocurrency exchanges, and they can be stored in a digital wallet, which is a software program that securely stores private keys that are required to access and transfer the currency.

Bitcoin is often referred to as “digital gold” or a store of value, as it has a limited supply of 21 million coins, and its value is determined by market demand. Some people also see it as a hedge against inflation or a way to diversify their investment portfolio. It is by far the largest cryptocurrency by market cap in the industry, accounting for the value of more than 40% of all digital assets in circulation combined, making it arguably the most popular crypto to buy.

Why Bitcoin?

Bitcoin underwent its 4th halving on April 20th, marking the reduction of block mining rewards from 6.25 BTC to 3.125 BTC. In the days after the halving, the price of Bitcoin shot up from about $60,000 to $66,000, about 10%.

Halvings are preprogrammed events that happen every four years and aim to control inflation by reducing the rate at which new coins are generated. This scarcity can impact Bitcoin’s price, often increasing it due to the reduced supply of new coins entering the market. Halvings will continue until the maximum supply of 21 million BTC is reached, which is a funda

Despite the impressive price rally we’ve seen in recent weeks and months, the current price level could allow investors to gain exposure to the coin at a discount before Bitcoin’s price starts to take off deeper into the post-halving cycle.

Historically, each Bitcoin halving cycle has brought new all-time highs, supporting the argument of those who advocate buying Bitcoin ahead of a halving event. Here’s a quick breakdown of the highest and lowest prices in each cycle, as well as the BTC price at the time of each halving:

| Lowest Price | Highest Price | BTC Price at Date of Halving | |

| 1st Halving Cycle (Nov 2012 – Jul 2016) | $12.4 | $1,170 | $12.3 (Nov 28, 2012) |

| 2nd Halving Cycle (Jul 2016 – May 2020) | $535 | $19,400 | $680 (Jul 9, 2016) |

| 3rd Halving Cycle (May 2020 – Apr 2024) | $8,590 | $73,600 | $8,590 (May 11, 2020) |

5. NEAR Protocol

NEAR Protocol is a layer 1 platform powering decentralized applications (dApps) and providing a foundation for the development of Web3 products and services. It facilitates the creation of scalable and high-throughput applications while ensuring security and accessibility.

One of Near Protocol’s unique features is its approach to scalability, which utilizes a consensus mechanism called Nightshade. Nightshade aims to enhance network performance by allowing parallel processing of transactions, potentially achieving higher throughput compared to some competing blockchain networks.

The platform also focuses on developer-friendly tools and usability, aiming to simplify the process of creating and deploying decentralized applications. Its emphasis on accessibility aims to make blockchain technology more user-friendly and approachable for a broader audience.

Why NEAR Protocol?

On March 27, the team behind the NEAR Protocol launched “chain signatures,” a new feature designed to improve user experience when using multiple chains. According to the project’s press release, the new feature allows DeFi apps to use digital assets across different chains without bridging them.

“Since day one, the NEAR ecosystem has focused on simplifying access to Web3 for developers and mainstream users. Chain Signatures is the next step in that journey, making it significantly easier to transact on any blockchain while also defragmenting liquidity across the ecosystem.” – Illia Polosukhin, co-founder of NEAR (source)

The improvements in DeFi usability are certainly a welcome addition to the growing Layer 1 ecosystem. According to DeFi Llama, NEAR Protocol’s TVL increased from just $35 million in April 2023 to over $304 million in April 2024.

The DeFi developments could also positively impact NEAR’s price. According to a crypto trader who goes by the name of “The Crypto Dog” on X, if the breakout above $7.5 occurs, NEAR could reach “new yearly highs” in the $11 to $13.5 range.

It’s worth noting that our own algorithmic prediction also forecasts a bullish period for NEAR, with a potential +49% weekly surge in the cards, which would push NEAR to $11.06 by April 15.

6. Dogecoin

Dogecoin, created in 2013 as a joke featuring the Shiba Inu from the “Doge” meme, rapidly evolved into a notable cryptocurrency. Developed by Billy Markus and Jackson Palmer, it aimed to be a more accessible alternative to Bitcoin with a larger, uncapped supply and lower transaction fees. Its primary use has been for online tipping and small transactions, supported by a vibrant community known for charitable activities.

Despite its humorous origins, Dogecoin gained serious traction, especially during the 2021 cryptocurrency boom, driven by social media and high-profile endorsements. Technically similar to Litecoin, it features faster transaction times due to shorter block times. This combination of community support and technical efficiency has maintained Dogecoin’s relevance in the volatile cryptocurrency market.

Why Dogecoin?

Dogecoin’s price rallied in the past couple of days, gaming more than 35% in the past week. The price rally coincided with Elon Musk’s post on X, which indicated that payments are coming to the popular social network. Given Musk’s well-documented support for Dogecoin, many investors are speculating whether X could support DOGE payments.

In addition to Musk’s somewhat cryptic X post, there have been other recent developments that have helped fuel positive market sentiment regarding the world’s oldest meme coin.

Leading crypto exchange Coinbase is launching futures for Dogecoin, Litecoin, and Bitcoin Cash in Apri. The news was confirmed on March 21 in a post on X.

Following the announcement, the price of DOGE went on a bit of a heater, rising from $0.148 to $0.172, recording a 16% increase between March 18 and March 25. The price increase came amidst a relatively bearish week for crypto, during which BTC, ETH, and other major cryptocurrencies traded in the red zone. Meanwhile, DOGE’s 16% surge was enough for the meme coin to handily beat all other top 10 cryptos in terms of weekly gains. In fact, the closest competitor was XRP, which recorded a modest 3% uptrend.

It’s worth noting that if history is any indication, we could see DOGE score even bigger gains going forward. For context – despite its impressive market streak in the past week – DOGE is currently trading at around $0.22, about 71% removed from its ATH. If the broader crypto market bull run kicks off post-halving, it’s not unreasonable to expect that Dogecoin might finally break $1 this market cycle.

7. Worldcoin

Founded in 2020, Worldcoin is a cryptocurrency project that is still under development, designed to be decentralized, open-source, and privacy-preserving. Worldcoin uses iris scanning as a way to verify users’ identities, which is intended to make it more difficult to create fake accounts.

The project, backed by OpenAI’s CEO Sam Altman, has attracted some significant investment, including from Andreessen Horowitz and Blockchain Capital. Worldcoin has the potential to be a major player in the cryptocurrency industry if it can deliver on its promises of privacy, decentralization, and openness.

Worldcoin is built on the Ethereum blockchain. This provides a secure and decentralized platform for storing and transferring WLD tokens. In addition, Worldcoin has a mobile app called World App, which allows users to scan their irises, claim Worldcoin tokens, and send and receive Worldcoin tokens.

The core feature of the Worldcoin project is the so-called World ID, which is a digital privacy-preserving proof of personhood. Each World ID is bound to a single individual and designed to be “very difficult to use by a fraudulent actor who stole or acquired World ID credentials,” per the project’s whitepaper.

Why Worldcoin?

Recently, Worldcoin has introduced two significant updates. Firstly, they have made key components of the software that drives their Orb scanner publicly accessible by open-sourcing them. Additionally, they are integrating a feature known as Personal Custody.

The now open-source software encompasses the code integral for image capture and transmission to the World App. This software, employed by the Orb devices, is accessible on GitHub.

The introduction of Personal Custody ensures that data produced from user interactions with the Orb scanner remains stored on the user’s own device. This affords users the control to erase their data or dictate its usage. Worldcoin reports that the development of this feature was influenced by consultations with privacy specialists.

While these announcements aim to address some prevalent criticisms of Worldcoin, the project still faces regulatory challenges globally. A notable instance is the demand from Spain’s data protection authority for Worldcoin to halt data collection in Spain and discontinue using already gathered data.

Additionally, it’s noteworthy that Worldcoin’s cryptocurrency, WLD, has exhibited modest performance recently. It has seen an approximate 11% increase over the past 30 days, a period marked by a generally bullish cryptocurrency market. In contrast, Bitcoin (BTC) has experienced a 21% rise in the same timeframe.

8. Ethereum

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a decentralized, open-source blockchain platform that allows developers to build decentralized applications (dApps) and smart contracts.

Ethereum has a wide range of use cases beyond just a store of value or medium of exchange. Ethereum’s smart contract functionality allows developers to build dApps that can run without the need for intermediaries, like centralized servers or institutions.

The Ethereum platform has gained widespread adoption and has become the backbone of the decentralized finance (DeFi) industry. DeFi applications built on Ethereum allow users to access financial services without relying on traditional banks or financial institutions. Ethereum’s smart contract functionality has also enabled the creation of non-fungible tokens (NFTs), which have gained popularity in the digital art and gaming worlds.

While Ethereum has a strong community and has been highly influential in the cryptocurrency industry, it also faces challenges, such as scalability issues and high gas fees. These issues have spurred the development of various Layer 2 scaling solutions. In the long run, future updates are supposed to massively increase Ethereum’s throughput bringing the transaction per second (TPS) figure from 15 to 100,000.

Why Ethereum?

After breaking $4,000 a couple of weeks ago, Ethereum retraced along with the rest of the crypto market and currently trades at $3,470. However, there’s reason to believe that Ethereum could bounce back to new heights due to a combination of technical and fundamental factors.

In recent days, Bitfinex’s analyst “Binhdangg” shared optimistic predictions for Ethereum in 2024. The analyst first pointed out that the ETH Mayer Multiple chart indicates that Ethereum could break $5,400 due to the “oversold condition this year.” “The upper band may be far above the $5,400 level by the time the price reaches those levels,” the analyst said.

Another point that speaks to Ethereum’s positive price activity in the coming months is the realignment of the Bitcoin to Ethereum ratio in terms of market cap. In the past couple of months, BTC has significantly outperformed ETH in terms of price gains, and the analyst believes that’s about change. “This would mean an approximate value of $5,900 for Ether based on the current BTC market price,” the analyst wrote.

Ethereum is the next major cryptocurrency that might be cleared by the SEC to get its own spot ETF in the US. Several prominent financial institutions have already filed their respective applications for an Ethereum spot ETF, including BlackRock, Fidelity, Grayscale, and VanEck. The next decision deadline for the SEC is May 23rd when the agency will publish its decision about the fate of VanEck’s Ethereum ETF.

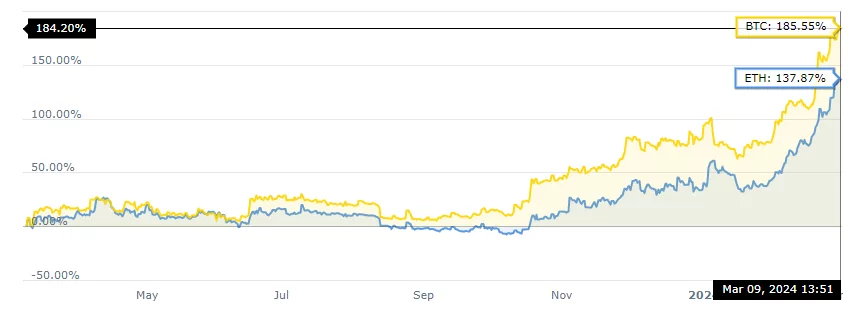

The hype surrounding an Ethereum spot ETF could fuel an ETH price rally that is very reminiscent of Bitcoin’s price activity over the past couple of months. Remember that Bitcoin significantly outperformed Ethereum between last year’s March and this year’s March, recording nearly 50% higher relative price gains.

9. Solana

Solana is a cryptocurrency and blockchain platform that was created to provide a fast, secure, and scalable infrastructure for decentralized applications (dApps) and token issuance. It was launched in March 2020 by Solana Labs, and quickly grew to become one of the largest blockchain networks in the sector.

Solana uses a unique consensus mechanism called Proof of History (PoH) which enables it to process thousands of transactions per second while maintaining a low transaction fee. This makes it one of the fastest and most cost-effective blockchains in existence.

In addition to its fast transaction processing speed, Solana also offers smart contract functionality and is fully compatible with the Ethereum Virtual Machine (EVM). This allows developers to build and deploy dApps on Solana using popular programming languages such as Rust, C++, and JavaScript.

The native cryptocurrency of the Solana network is called SOL, which is used as a medium of exchange and a store of value within the ecosystem. SOL is also used to pay for transaction fees and other network services.

Following explosive growth in 2020 and 2021, Solana hit a rough patch in 2022 due to the broader crypto winter. The negative market activity for SOL was exacerbated following the collapse of the FTX exchange, which was one of the biggest investors in Solana. The SOL coin fell all the way down to $10 in late 2022 (95% removed from its ATH of ~$260) but has since recovered a significant chunk of its losses.

Why Solana?

Solana has been on a tear lately, gaining 39% in the past 7 days and more than 935% over the last 6 months. On March 18, it managed to break an important psychological barrier of $200 for the first time since the 2021 bull run.

Several notable developments in the Solana ecosystem have contributed to the impressive price performance. In January, the team announced token extensions, giving developers much more flexibility over how their digital assets work (including whitelisting addresses, setting automatic transaction fees, and supporting confidential transfers).

At the same time, tokens launched on the Solana blockchain attracted many investors, underscoring the fact that Solana is a layer 1 chain comparable to Ethereum in terms of token support and smart contract capabilities. Over the past couple of months alone, we’ve seen BONK, WIF, and JUP shoot up by hundreds of percent and reach billion-dollar market caps.

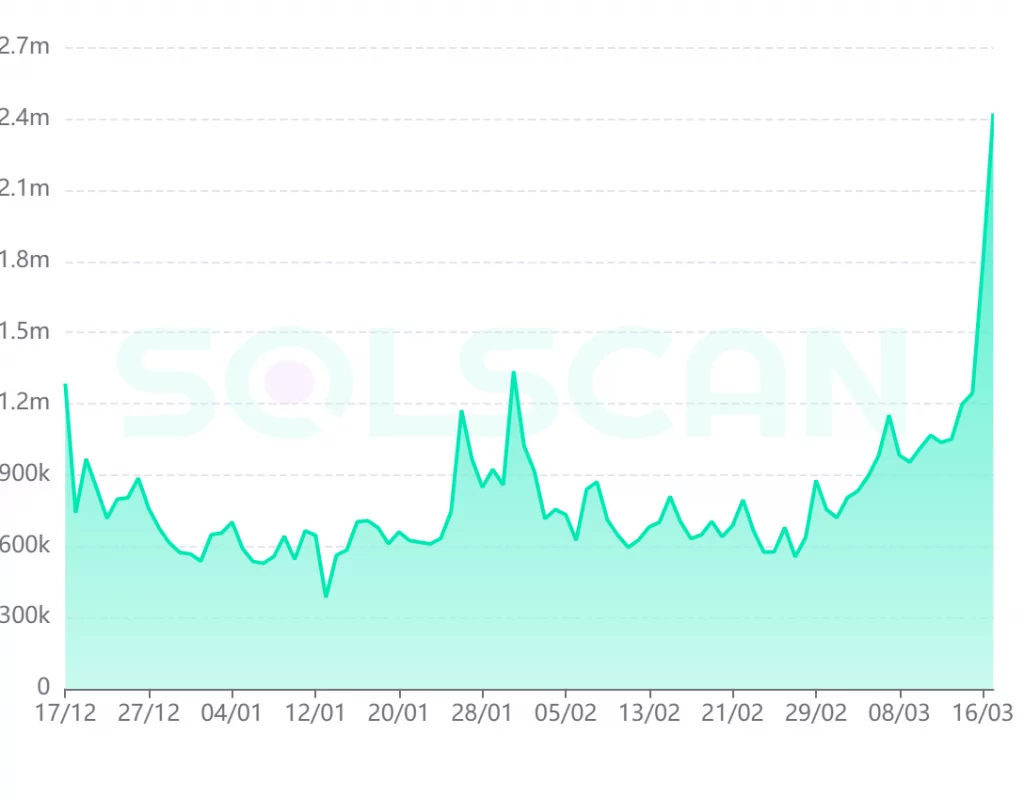

This trend has contributed to a large influx of new users and growth in the chain’s TVL. According to Solana explorer Solscan, the number of active wallets reached the highest level in more than 2 years in March.

In addition, on January 16, Solana announced Saga 2, the successor to the popular Web3 phone that launched last year. The presale numbers for the second version of Solana’s mobile phone have reportedly been very encouraging. “We outsold 1 year of Saga sales in 24 hours,” noted Solana co-founder Raj Gokal in a post on X.

In addition to Saga and the large influx of new users and tokens, Solana achieved another important milestone this year. On January 18, Paxos announced that its stablecoin Pax Dollar (USDP) has launched on the Solana mainnet. At the time of writing, USDP is the 8th largest stablecoin by market capitalization with $189 million. Its launch on Solana could help boost DeFi activity on the Solana chain and unlock additional liquidity for the growing ecosystem.

10. Bittensor

Bittensor (TAO) is a decentralized network designed to facilitate collaboration and intelligence sharing among AI models using blockchain technology. The platform allows machine learning models to interact autonomously, sharing data and computing resources across a secure, distributed system. Participants can contribute AI models that benefit from real-time updates and improvements contributed by the collective network.

Bittensor utilizes its native cryptocurrency, the Tao token, as a means of rewarding participants for their contributions of data and processing power. The protocol aims to create a self-improving ecosystem of AI that operates beyond the control of any single entity, promoting a new paradigm in machine learning development. This decentralized approach ensures transparency, security, and scalability, making advanced AI more accessible and effective.

Why Bittensor?

On April 11, Binance, the world’s largest cryptocurrency exchange, listed Bittensor on its platform. The TAO coin was listed in four trading pairs: Bitcoin, Tether, FDUSD, and TRY.

Immediately after the listing, the price of TAO surged to a new all-time high above $780. Even though the price of TAO retraced to $565 in the days after the listing, it’s still up more than 1,070% in the past six months, which is fifth-most among the top 100 cryptocurrencies by market cap.

The listing of TAO on Binance could give it additional momentum and help it reach new highs in the coming months, especially if the cryptocurrency market kicks into a higher gear after the next Bitcoin halving like it did in the previous halving cycles.

11. Fetch.ai

Fetch.ai is a platform focused on leveraging artificial intelligence (AI) and blockchain technology to empower scalable and interoperable solutions in various sectors. It enables the creation of decentralized digital entities, termed “autonomous agents,” which can perform a range of tasks, from optimizing supply chains to facilitating data trading.

Fetch.ai’s technology integrates AI, machine learning, and blockchain, fostering an environment for the emergence of the “Economy of Things,” where agents autonomously interact and transact. The platform’s ecosystem promotes innovative applications in fields like mobility, IoT, and data sharing, aiming to simplify and enhance processes through AI-driven solutions.

Why Fetch.ai?

Recently, many investors have turned their attention to artificial intelligence – we’ve seen this with triple-digit increases in the value of some AI stocks, most notably Nvidia. The trend has found its way to crypto markets as well, with demand for AI crypto tokens skyrocketing.

Fetch.ai, being at the forefront of AI and crypto, has benefited from this trend tremendously, gaining more than 360% in the past month alone. In the same period, the team behind the project announced several things that helped fuel the price growth.

Most importantly, the team has announced a massive $100 million investment toward creating Fetch Compute, a platform that “developers and users can utilize for computing power.” The platform will use Nvidia H200, H100, and A100 GPUs. Speaking about the launch, Humayun Sheikh, CEO of Fetch.ai, said:

“Fetch Compute is not just an infrastructure investment; it’s an investment in the future of AI and the ecosystem of innovative developers who are pushing the boundaries of what’s possible with our platform. By marrying substantial compute resources with our unique compute credit system, we’re ensuring that our community has the support and tools necessary to bring their visionary AI projects to life.”

The launch of Fetch Compute ties into the project’s existing offering of AI-focused products and services, including the LLM-based DeltaV platform and app marketplace that connects users with services.

12. BNB

BNB, a crypto asset originally launched by the Binance cryptocurrency exchange in 2017, is a token with two main roles. Token holders enjoy exclusive perks while utilizing Binance, such as reduced trading fees, entry to the exchange’s Launchpad and Launchpool programs, cashback rewards on Binance Visa card transactions, and more.

Additionally, the token serves as the native asset for the BNB Chain blockchain. BNB Chain, a variation of Ethereum, offers users much lower transaction fees and supports EVM-compatible decentralized applications, providing an easy transition for developers who are accustomed to building on Ethereum. Originally named Binance Coin, BNB has undergone a comprehensive rebranding in recent years.

Why BNB?

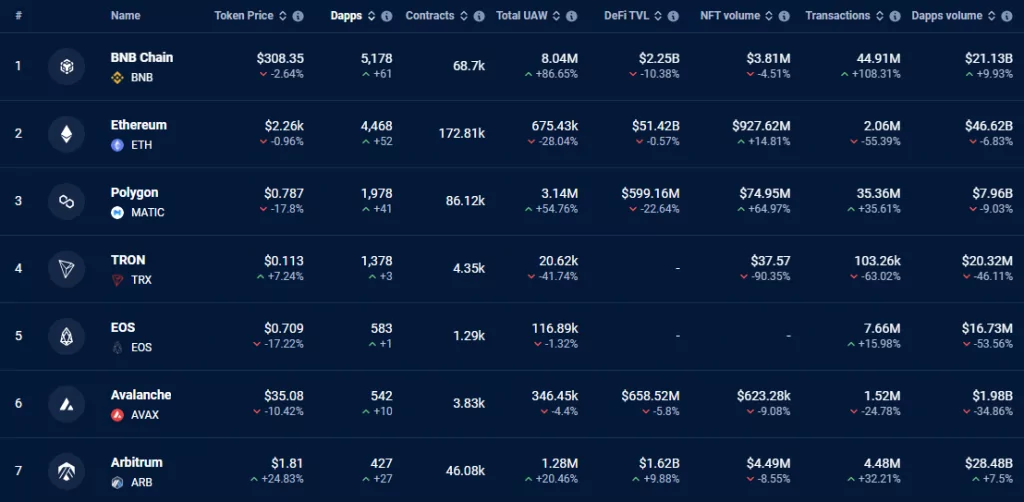

Since the start of the year, BNB Chain has further increased its lead over Ethereum and other layer 1s in terms of dApps deployed on the platform. According to DappRadar, BNB Chain now houses 5,178 dApps, compared to second-placed Ethereum’s 4,467 and Polygon’s 1,978.

In addition to encouraging DeFi metrics, the Binance cryptocurrency exchange has ramped up the pace of introducing projects on its Launchpool platform, with several consecutive announcements in quick succession — XAI, Fusionist, NFPrompt, and Sleepless AI.

The Launchpool announcements have resulted in increased demand for BNB, which has increased in price by about 29.5% in the last 2 months.

Through Binance Launchpool, users can stake their BNB to earn tokens from upcoming blockchain projects. The flexibility to unstake BNB at any time allows users to gain new tokens while assuming relatively low risk during the staking period.

It will be interesting to monitor Binance in the upcoming days to see if they announce another Launchpool program or, potentially, even a new Launchpad program. Such announcements could potentially trigger another uptick in the price of BNB.

Best cryptocurrencies to buy at a glance

| Native Asset | Launched In | Description | Market Cap* | |

| Hedera Hashgraph | HBAR | 2017 | Crypto network based on the Hashgraph algorithm | $3.68 bln |

| Helium | HNT | 2019 | A decentralized IoT blockchain network | $844 mln |

| Toncoin | TON | 2020 | A blockchain designed by Telegram and run by the community | $17.8 bln |

| Bitcoin | BTC | 2009 | A P2P open-source digital currency | $1.42 tln |

| NEAR Protocol | NEAR | 2020 | A highly scalable DeFi-focused blockchain | $7.88 bln |

| Dogecoin | DOGE | 2013 | The original meme coin | $23 bln |

| Worldcoin | WLD | 2023 | A proof-of-personhood crypto project | 1.36 bln |

| Ethereum | ETH | 2015 | The leading DeFi and smart contract platform | $433 bln |

| Solana | SOL | 2020 | One of the fastest and cheapest L1 blockchains | $92.4 bln |

| Bittensor | TAO | 2023 | Machine learning blockchain platform | $3.66 bln |

| Fetch.ai | FET | 2017 | A leading AI crypto project | $1.94 bln |

| BNB | BNB | 2017 | A popular crypto asset enjoying support from the world’s biggest crypto exchange | $47 bln |

Best crypto to buy for beginners

If you are just starting out in crypto, it is advisable to stick to cryptocurrency projects that are less prone to volatility and are generally more established. While this approach does have a downside, as it becomes much more difficult to expect triple-digit or larger gains, the major upside is that you are not exposed to projects that have a chance of failing and, thus, losing your entire investment.

In order to identify projects that are stable and thus feature low volatility, you can start by following the parameters listed below:

- The crypto asset has a market capitalization that places it into the cryptocurrency top 100 (roughly $550 million as of early 2024)

- The crypto asset is available for trading on the best crypto exchange platforms and can be exchanged for fiat currencies

- The crypto asset boasts healthy liquidity ($100M/day and more), which allows you to execute buy and sell orders quickly and without slippage

- The crypto asset is part of a reputable crypto project with clear goals, a realistic roadmap, and products and services that look to address real-world problems

Some of the best cryptos to buy for beginners are those that follow the above criteria and have earned their standing in the crypto market due to robust security, popular products and services, and clear growth potential. Some beginner-friendly crypto investments are:

- Bitcoin

- Ethereum

- Litecoin

- Cardano

- BNB

It is worth noting that cryptocurrency investments are inherently risky, even if you stick to the biggest and most reputable projects. The reason for this is simple – the crypto sector is relatively new, and the landscape might look completely different in the future.

Best crypto for long-term

When deciding which cryptocurrency to buy for the long term, it’s important to consider projects that are well-established, have a strong community, are highly liquid, have a large market cap, and have a clear reason for existing (such as solving a real-life problem, introducing new functionality, etc.). Without these characteristics, a project might fail to survive in the long term, rendering it a bad long-term investment.

It is worth noting that, typically, most long-term crypto investors are looking for projects that have the potential to generate decent returns but also provide a degree of investment stability. Roughly speaking, only the largest cryptocurrencies fit the bill, as others have a low market cap and liquidity that doesn’t bode well for a long-term commitment (unless you’re prepared to take on more risk).

In addition to Bitcoin and Ethereum, there are a number of other cryptocurrencies that fit the criteria of being low-risk, long-term crypto investments.

If you are planning to hold onto your digital assets for a longer period of time, it is best to take care of crypto custody yourself. Holding large amounts of crypto on an exchange can be risky, as we’ve seen over the years with the collapse of high-profile exchanges like Mt. Gox and FTX. Use one of the reputable crypto hardware wallets to store your crypto. Ledger hardware wallets, for instance, allow you to manage your crypto holdings easily and provide a much higher degree of security than crypto exchanges or even software crypto wallets.

Best place to buy crypto

One crucial aspect to consider when choosing which platform to use to buy crypto is the range of cryptocurrencies and trading pairs available. Since different exchanges support varying digital assets, it’s important to choose a platform that accommodates the specific cryptocurrencies you intend to trade.

Additionally, assessing an exchange’s liquidity and trading volume is essential. Higher liquidity generally results in improved price stability and faster trade executions. Furthermore, it is prudent to examine the fees charged by the exchange, encompassing deposit, withdrawal, and trading fees. Comparing fee structures across different exchanges can help you identify the most cost-effective option that aligns with your trading style. With that said, here are some of the best exchanges on the market right now:

- Binance – The best cryptocurrency exchange overall

- KuCoin – The best exchange for altcoin trading

- Kraken – A centralized exchange with the best security

By diligently considering these factors, you can make an informed decision and select a cryptocurrency exchange that meets your requirements for security, variety, liquidity, and affordability.

How we choose the best cryptocurrencies to buy

At CoinCheckup, we provide real-time prices for over 22,000 cryptocurrencies, with the list growing by dozens each day. As you can imagine, making a selection of a dozen top cryptocurrencies to buy out of such an immense dataset can be difficult and will for sure lead to some projects that should be featured being omitted. To minimize the chance of that happening, we follow certain guidelines when trying to identify the best cryptocurrencies to invest in.

Availability

One of the most important factors for any cryptocurrency investment is the crypto asset’s availability, meaning how easy it is to buy and sell it across various cryptocurrency exchanges. We tend to stay away from assets that are not available on major exchanges and require complex procedures to obtain.

Market Capitalization

Another important metric for identifying whether a crypto project is worth covering its market cap. A high market cap means that the project has reached a certain level of adoption from users, making it less risky to invest in.

Growth Potential

While this metric is mostly subjective, it is still an important metric on which we curate our selection. We won’t feature projects that we think are stagnating or have no real upside in the future.

Purpose and Use Case

We consider the purpose and use case of cryptocurrency, particularly in a real-world setting. Some cryptocurrencies focus on specific industries or applications, such as decentralized finance, gaming, or supply chain management.

Team and Development

The team and people involved in the project can tell you a lot about the potential of a particular cryptocurrency project. We examine the team’s experience, expertise, and track record and evaluate the development activity and updates to ensure the project is actively maintained and evolving.

The bottom line: What crypto should you buy right now?

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Meanwhile, those with a higher risk tolerance might see Bitcoin as too stable, looking instead toward newer and smaller projects that carry a higher degree of upside.

No comments